Applying AI automation in app review management: webinar recap

Table of Content:

Traditional review responses are a vast time sink. Our recent webinar, led by Karen Taborda from AppFollow, Nkoebe Motlhajoa from Standard Bank, and Ilia Kukharev also from AppFollow, explores smarter methods.

In this recap, you’ll get the straight talk on handling typical hassles with automation and AI—speeding up the whole process to the limit. Let’s take a look!

Or better yet, watch the entire webinar:

The current state of engagement

Engagement is difficult to achieve: the market's flooded with tools, everyone's after the same crowd, and feedback is through the roof. Too many channels lead to burnout as companies scramble to keep up. Wasting time sifting through feedback is another headache, with key points often overlooked.

Customers demand quick, sincere replies. Engagement teams are swamped and can't keep up without AI and automation, especially in the finance sector.

How important is brand reputation to the finance sector?

People talk about personal brands, so let's get clear on what brand reputation actually means.

Warren Buffett said it takes 20 years to build a brand and five minutes to ruin it. Jeff Bezos said a brand is what people say about you when you're not around.

From Standard Bank's angle, integrity is key in managing the brand. Integrity means doing what you promise. Customers trust you more if you keep your promises. Trust leads to loyalty, and in finance, people won’t invest their savings if they don't trust you. Before you roll out services on any platform, establishing trust is a must for customer engagement. This trust builds loyalty, making customers confident they can depend on anytime.

You can’t maintain a brand without customer engagement. Standard Bank’s team has responded to every client on our app, available on iOS, Android, and other platforms. However, quick responses aren’t enough. The credibility of the information is just as important. Quick but accurate responses maintain trust.

Customer experience = customer satisfaction.

Standard Bank improved the satisfaction scores by resolving issues—that’s how you can build trust and make customers confident about coming back with their concerns. Efforts made this way have boosted their customer sentiment score to 90%!

What are the biggest app reputation challenges?

Businesses these days handle a ton of comments, deal with different languages and work with whatever little resources they've got.

That’s why AppFollow offers its AI arsenal—the solution sorts all the feedback and picks out the important bits, like major bugs or complaints that need quick fixing. It also helps break down language issues by summarizing and translating feedback so everyone can understand it.

For instance, during a typical eight-hour workday where handling feedback takes ten minutes per item, you can automate the praise to save time for serious issues like customer complaints or specific feature requests that require more focus.

This means less time wasted on sorting feedback manually, and more time improving what users actually care about, which boosts trust in your business. AppFollow’s AI starts by grouping feedback into themes to pinpoint the big problems. Then, it sifts through thousands of comments to pull out useful tips that can guide what you do next and really meet users' needs. And finally, it uses AI to tackle their issues head-on.

Here’s how you do it, step by step.

Step 1: automatic categorization into topics

First off, AppFollow grabs thousands of reviews and lets the AI sort them into different buckets by topic. This way, you can quickly spot big issues, like login troubles, which everyone knows are a real pain in finance apps.

Thanks to this automation, you don't have to waste time reading every single review. Instead, you can zero in on what your customers actually need.

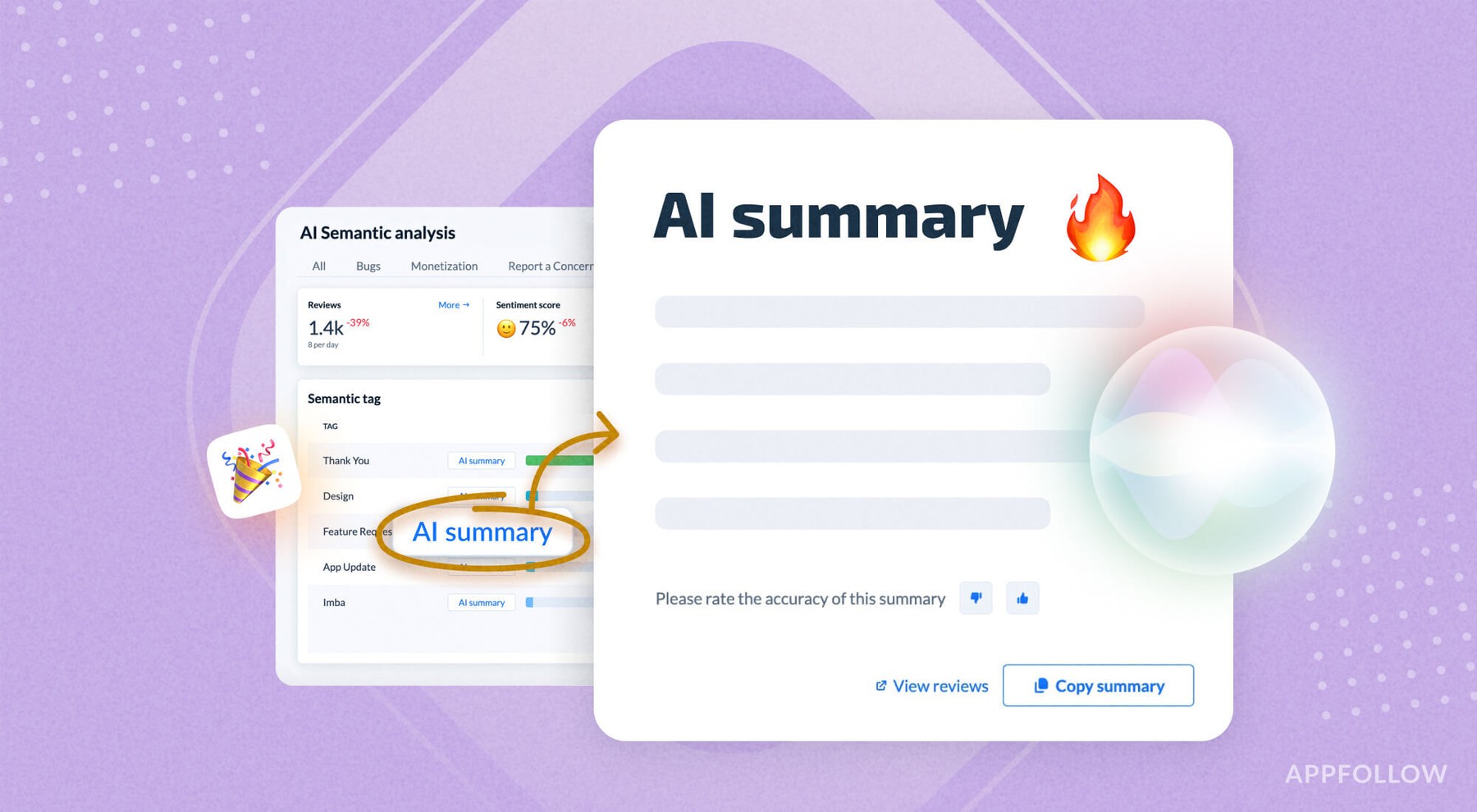

Step 2: summaries for topics, reviews, and tags

Basically, you use the semantic tags, click on one, and boom—you get a neat summary of everything said about that topic. This tool is great for spotting big issues across different countries and languages.

Also, it's super important to give a shoutout to the good reviews too. It keeps the team pumped and shows off how solid your app is, how good the customer service is, and what kind of tech you're using. When you bring up this positive feedback in big meetings, it really shows that customers like what you're doing.

Plus, you can use these AI summaries smartly in your marketing. Throw some of that positive feedback into your App Store screenshots, Google Play, or Facebook ads, and it highlights the best stuff your app offers and boosts your promo efforts.

Step 3: Prioritizing feature requests and bugs

Next up, we've got to sort out which features people actually want—things like spending trackers, new investment choices, and making transfers just by punching in a phone number. This feedback is great for stuffing your development queue with the right projects.

By zeroing in on these hot requests and the bugs that need squashing, you make sure you're using your resources wisely and exactly where your customers want you to. You get a clearer picture of what your customers are after.

Step 4: Responding to reviews with AI automation

The last step is talking to your customers.

The AI handles simple thank-you notes well, but do tell customers to contact support for anything more complicated. Automated systems can't handle everything—not yet.

This saves a bunch of time—and—shows you're serious about keeping your rep shiny. While you're busy fixing real issues and dealing with heavy problems, AppFollow’s AI makes sure to send out thanks and pats on the back to satisfied customers. This keeps them happy while you tackle the bigger tasks.

When it comes to solving complex issues, speed matters because it affects job performance. Automation is good for the easy stuff, but the tough cases still need a human touch. Expect a response within 30 minutes to an hour, either online or directly.

App review automation at Standard Bank

AI gets smarter by processing heaps of customer chats. This means the bots can take the mundane problems off agents’ plates and let them crack the hard nuts that need a human touch. It’s quicker for customers, and lets agents dive deep when needed, which only makes our service better and faster.

On the self-help front, this makes life easier for the clients and the bank. Thanks to all this tech, 80% of feedback is sorted fast, and our clients can often fix their own issues. The other 20%? Real people are ready to step in and help out.

Just to throw in some numbers—after AI was introduced, the thumbs-ups from customers shot up by 646%. The system’s doing something right. And no, AI isn’t stealing jobs; real brains are still needed for the big stuff.

Moving forward, the aim is to keep tackling problems fast, and keep rep as a solid, helpful bank. This focus on service keeps the bank in step with new trends, making everyday banking—and life—a bit smoother for the bank’s clients.

The whole system works like it this: it grabs all the feedback from the app, sorts it out by topics on its own, sums it all up, figures out what needs fixing or upgrading first, and then gets back to people. This setup saves a bunch of time, money, and hassle, cuts through any language mess, and makes sure customers are helped fast.

Afterword

Looking ahead, especially in banking, the trend towards self-service with human backup marks a big change. If you’re dealing with a lot of customer reviews, especially in finance, you should look towards adding AI to your own arsenal now.

FAQ

Is using AI for responding to app reviews a good idea?

AI cuts down on the grunt work of sorting app reviews. It categorizes, summarizes, and responds to feedback fast. Your teams can focus on serious issues rather than manual sorting, which is extra important in the finance sector.

How does AI boost customer satisfaction in finance apps?

AI speeds up response times and handles routine queries. That’s how you can improve customer satisfaction scores, as issues get resolved faster.

What can't AI do in managing app reviews?

AI isn't great at complex problems that need human insight. It can start conversations and sort issues, but humans must step in for nuanced or detailed customer support. AI helps with the basics, but real people should handle the tough problems.

Read also

- Don't know how to do online reputation management? Read this now.