Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

User reviews affect conversion to installs and app rating. Featured and helpful reviews are the first to be noticed by users and in case of no response can affect download rate.

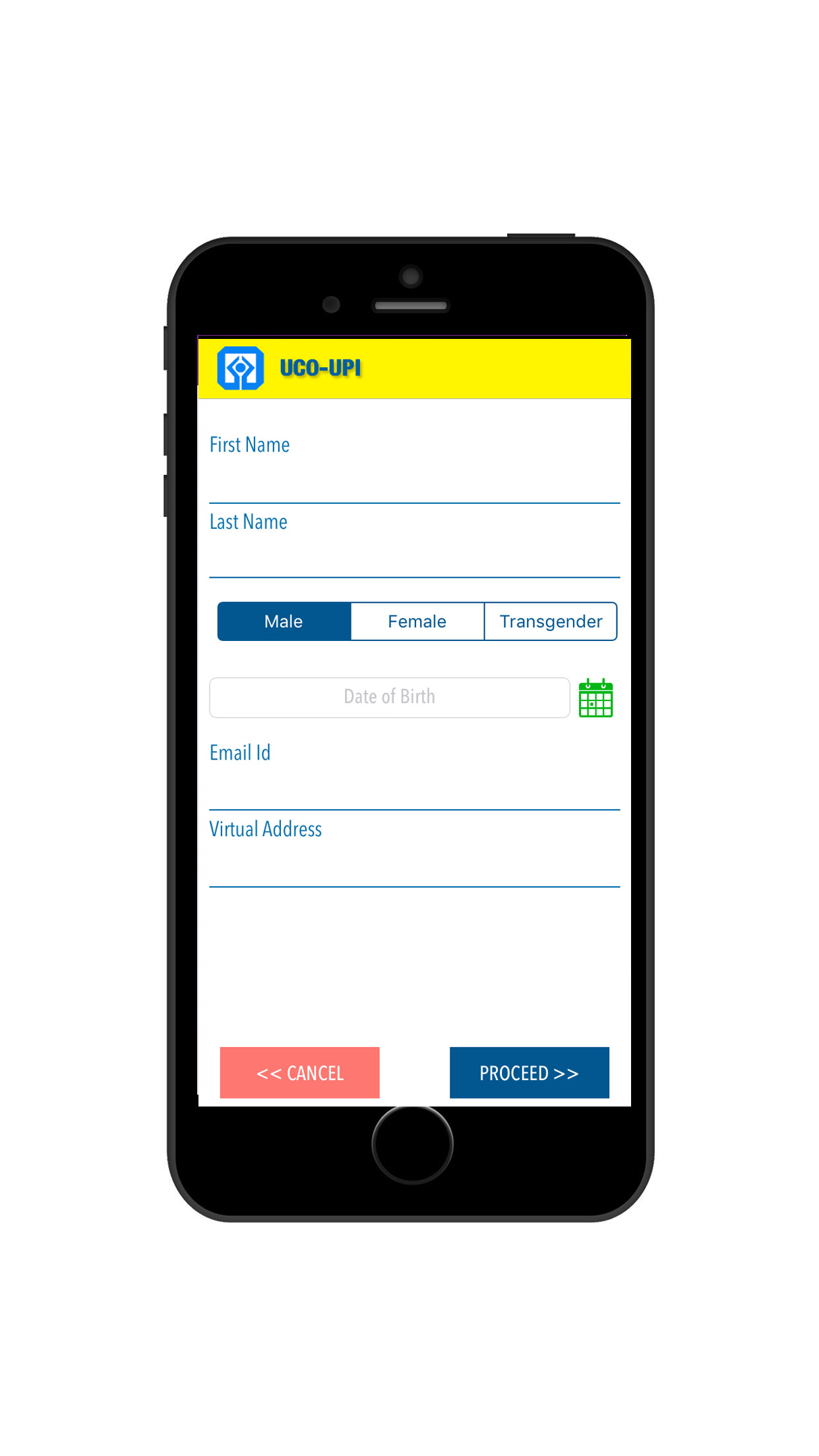

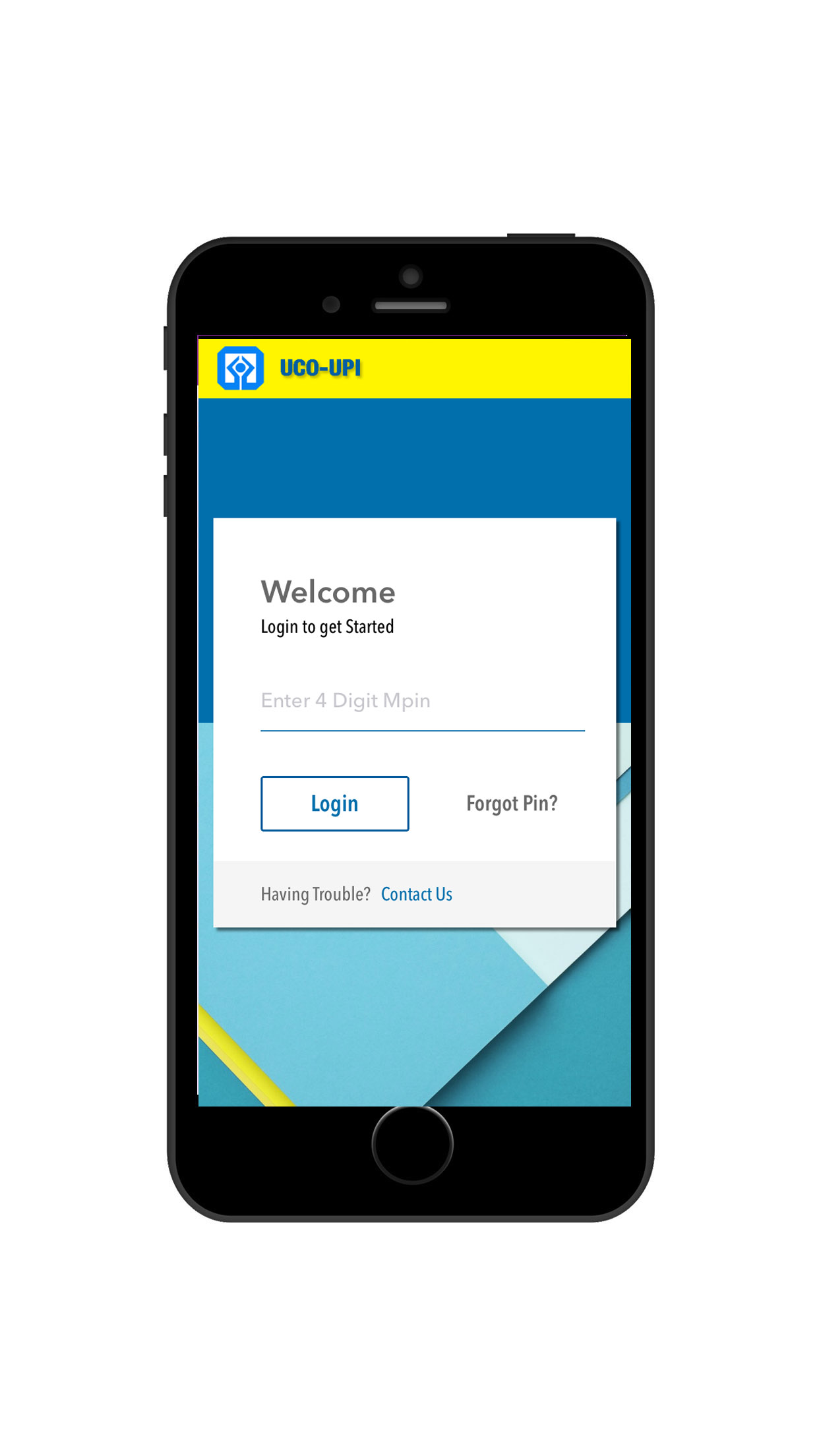

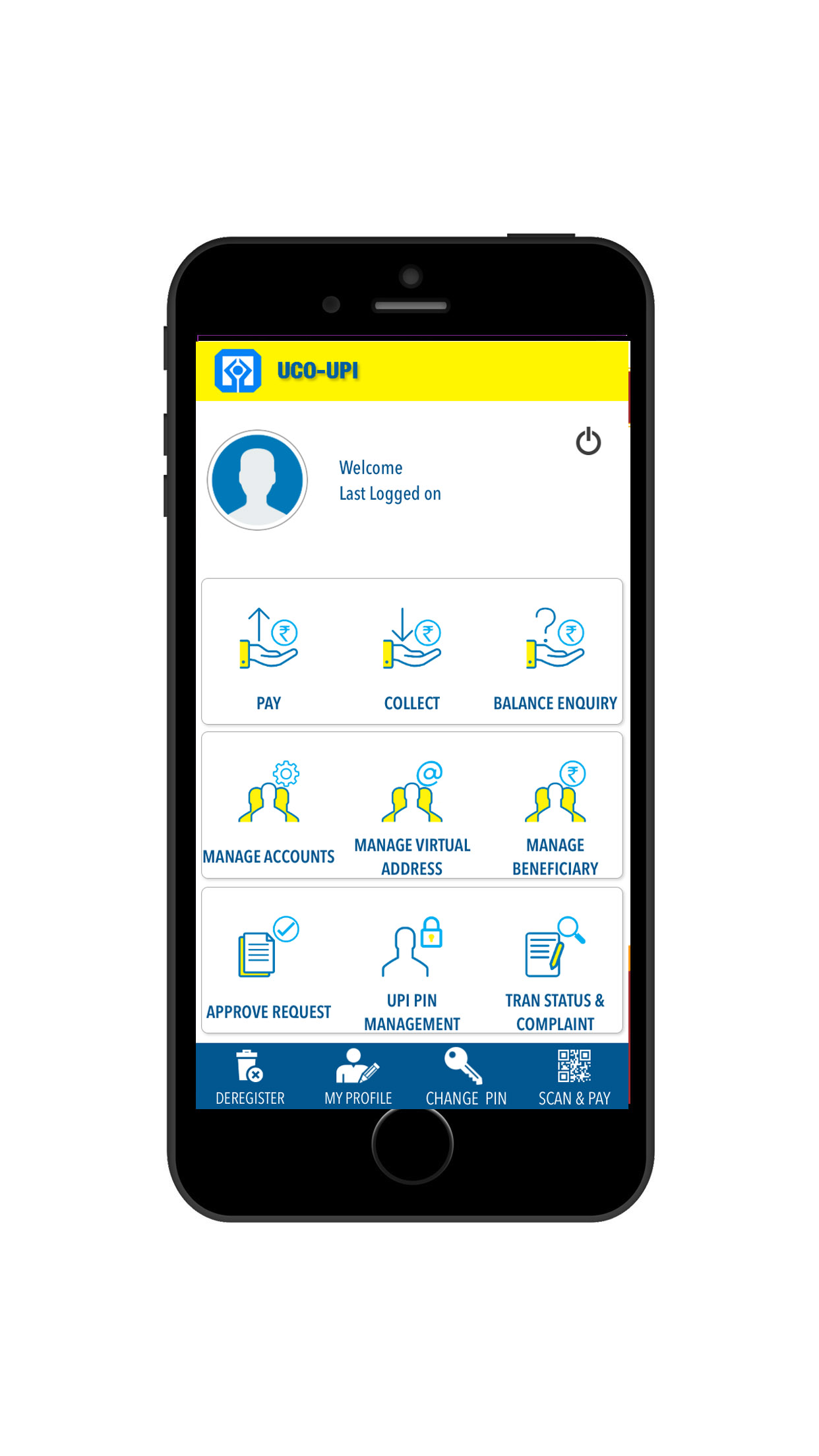

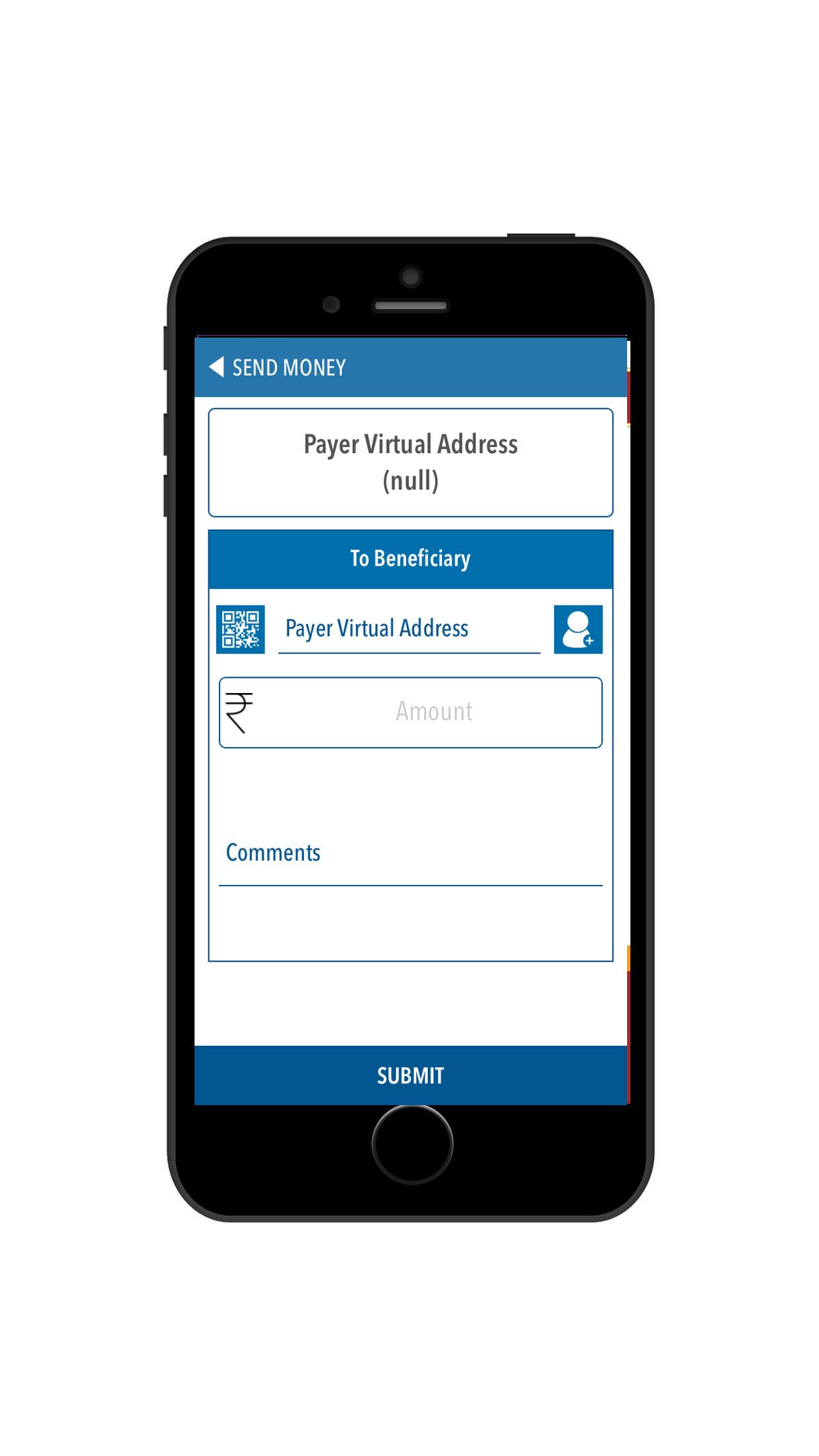

UCO Bank launches official UPI-Unified Payment Interface app for all banking needs of customer. UCO Bank is a commercial Bank and a Government of India undertaking and providing various services to its customers. BHIM UCO UPI-Unified Payment Interface allows customers to Pay/Collect money using Virtual Private Address. Virtual Private Address is unique for each customers account. Customer can download the UPI app and install it in device(Mobile/ Tablets). While doing the registration, UPI app communicates with NPCI in encrypted data format. The customer has to create virtual address and complete profile information. The customer can add UPI enabled Bank accounts based on their Mobile Number registered in banks. After adding the bank account, it has to verified using debit card information and set MPIN using OTP. After debit card verification, the customer can pay/collect to other bank accounts. The customer can do the balance enquiry. UPI uses IMPS as underlying base. The customer can use P2P(using MMID and Mobile of Remitter), P2A(using IFSC and account), P2U (AAdhar payments) and VPA(Virtual Private Address) for doing payments. The customer can initiate collect request to other UPI customer. It will appear in Collect Authorisation option where user can accept or reject requests. The transaction history shows details of all payment and collect requests. Using Add beneficiary, the customer can add beneficiary of other banks for doing payments. The Unified Payment Interface allows payments to be initiated by the payer, or by the payee. In the basic payee initiated flows, the payment request is routed by the initiating application through the NPCI switch to the payer for approval. However, in certain instances, where it is possible to connect with the payer immediately, it is preferred that the payee sends a payment request to the payer, who can then initiate the payment request with his credentials. Unified Payments Interface (UPI) is an architecture and a set of standard APIs to facilitate the next generation online immediate payments leveraging trends such as increasing smartphone adoption, Indian language interfaces, and universal access to Internet and data. UPI is launched by National Payments Corporation of India with Reserve Bank of India's vision of migrating towards a 'less-cash' and more digital society. NPCI has built on the Immediate Payment Service(IMPS) platform through which one could transfer money instantly by going online-by adding another layer that allows easy debit capability even on mobile phones. Bank as a part of digital banking, is introducing QR code for its BHIMUCOUPI. This will facilitate in leveraging quick fund transfer and healthy replacement of PoS (Point of Sale).