Houston, we’ve got… investments

Table of Content:

After we received our angel-backed investments in Spring of 2016, we thought we could close our next round in less than a year. But life turned out to be much more complicated than any plans — lots of things went the opposite way of how we thought they would. So only in Summer of 2017 we finally decided to take off in our investment crusade.

On February 14th, 2018, St. Valentine’s day, we signed docs with Finnish investment fund Vendep Capital. All in all it took us almost 8 months to sign deal papers after we made our initial decision to raise money. And we though that it would a good thing to share our experience on how we actually did it.

Why?

A good way to start your investment activities is to sit & think of a simple question: “What really for do we need investments?!” Of course, you can just use one of the popular templates, like “scaling the channels” but this suits pitching competitions more. In reality your should be able to deliberately explain why you startup needs that much money.

So, to find out what actually we need as a company, all three AppFollow founders got together in our favourite WAR ROOM at Startup Sauna. We spent two days on reviewing our current state, discussing our future plans and how we can make this plans come true. As a result, we stated our key targets we wanted to achieve if we raise money. And, just in case, we had our plan B if we don’t succeed in fundraising.

The ground layer in our plan was our service — we need to continue developing it & bring it to the next level. So we outlined three major products we want to scale within AppFollow, we set a list of employees we need to hire and calculated their cost. The second layer of our plan was marketing. It was clear that the competition is getting tougher and we need to learn how to stand out & show off to our customers.

And at last we created our first invest deck where we tried to briefly depict our current results, our plans and visions.

But the most helpful tool to answer “Why we need these money?” was our business plan. We literally calculated how our company can change in terms of metrics and financial results if we raise. And that helped to calculate how much do we actually need. This business plan helped us a lot when we were in talks with our potential investors.

Value for money

Business plan gave us a clue on how much money we want to raise. But how much do we eager to sell for it? To calculate that we used our own advise from before— we modelled our cap.table with several future investment rounds thus getting an understanding where we can end up within next few years. Thanks to that practice we’ve got a set of parameters for the round which we considered good for both us & potential investor.

So, at the end of summer 2017 we made a decision to raise, prepared a business plan, calculated possible investment parameters and created an investment deck. With all that we felt ready to start actually talking to investors.

As a last thing in our preparations we decided that we’ll fundraise until the end of 2017. If we fail by the end of the year, we’ll stop all these activities, get together & make one more planning session to review the reasons for not succeeding with the round.

To sum up, we actually spent 2 months only to prepare for the possible negotiations. During that time we analysed our current state, set up a plan of where we can get to if we raise money and prepared the docs for possible investors.

Who & why?

What is the actual way to find investors? First of all, we showed all that we prepared to our current investors. And we were quite surprised when one of them proposed not to raise money but instead bootstrap as we were already on break-even.

His view based on the idea that as we were already earning some money thus we don’t actually need to raise as this might lead to less flexibility in decision making. And instead of valuations we can target future dividends. But we decided that raising money is more preferable mainly because we’ll have a chance to grow much faster.

We then decided to talk to those who already got investments in the last few years. We wanted to learn about their experience, results and — mostly important— outcomes they got to. As well, we thought that they might make an introduction. During September & October we met several founders, one of them was Pekka Koskinen — founder of Finnish startup LeadFeeder. It was him who introduced us to Vendep.

Last but not least was usual ‘hustling’: since our first round we collected a pull of investors who got interested in AppFollow. And we’ve been updating them on a quarterly basis on our progress. So we can definitely target them with our proposal.

When we opened that list, we asked ourselves: “Whom do we want to see as our investors most of all and why?” The answer was as follows: we wanted to find an experienced partner who will help us in solving all the problems that our company is facing at the moment or could face in the future. It would be a great plus if our investor has a proper experience in growing SaaS companies.

So, as a next step, we created a list of very different people but all of them had one thing in common — we though they can be a great add to our team. Among others we had Ilkka Paananen (yes, yes, CEO of Supercell), Bayram Annakov (CEO of App in the Air), Y Combinator (accelerator #1 in the world) and few others. We thought of how we can approach everyone on the list to learn whether or not they could be interested in investing in AppFollow.

And, of course, participating in Slush — biggest European startup-conference. You can definitely meet your future investor there.

So, before engaging in real battle, spend some time on exercises meaning before approaching investors whom you wish to see on board, talk to those who can help you in actually getting them on board. This can be some more experienced founders, angels or VCs that you don’t plan to target but who can still share some advice.

Within one month we talked to several founders & VCs who provided quite a feedback on our proposal. This lead to updating our invest-deck & pitch. At the end we felt much more confident & prepared.

Result

As I mentioned earlier, after we met Pekka from LeadFeeder, he introduced us to one of his company investors — Finnish VC called Vendep Capital. That was very fortunate for us:

- Vendep makes seed investments focusing on SaaS companies;

- They just announced their second €32 mln fund from which they already invested in several companies;

- Their initial investment falls exactly into the range which we defined for us.

It looked like we were meant for each other. We as well talked to some other companies they invested in, and received a very positive feedback. We also learned that Vendep had few “exits” which we considered important as well.

But there was one thing against us: Vendep clearly noticed that they are looking into companies with at least €30k in monthly recurring revenue, while we had almost less than a half of that. At the beginning we thought that wouldn’t give us a chance.

Even by the time when we were ready to sign the deal, our MRR just hit €20k and we were constantly growing with 10% month-over-month. So, we never made it to €30k, but we had very good results in terms of overall revenue, stable month-on-month growth and we were on break-even. All this together, as we believe, convinced Vendep to make a positive decision about us.

We had our first meeting with Vendep partner — Jupe Arala — in the mid of September. Both of us had a very positive impression, so we decided to meet once again to discuss things in more details. That’s why few weeks later we had our next meeting with all AppFollow founders on one side & all Vendep partners on the other. We discussed our service, customers, metrics, how we got into that boat, what are our plans and many more.

By the way, it’s important when you deal with a VC talk to the partners as they are the persons who make decisions. If you spend more time with analysts, it might be so that you’re just loosing your time.

At the end of the meeting we proposed to Vendep with our invest.round estimates — how much we’re looking for, share of the company & valuation. Partners were interested and few days later they send us their counter-offer.

We already knew that quite often funds that make seed investments target a particular amount of shares in the company they want to invest in. And as they usually have a minimum check they pay, this gives an estimate of probable company valuation (and not company’s income or other metrics). So, the idea here is whether or not you’re ready t meet this figures. Our own calculations of needed funding and amount of shares for sale also gave us a view on possible valuation. So, when we started to discuss the actual deal with the fund, we simply adjusted our terms to suit both them & us.

It took us just two weeks to finalise on the terms sheet. That kind of speed was a pleasant surprise for us (we had quite an opposite experience from before). And we were already ready to sign the paper when all of a sudden there was an invitation for the interview from Y Combinator.

YC Interview

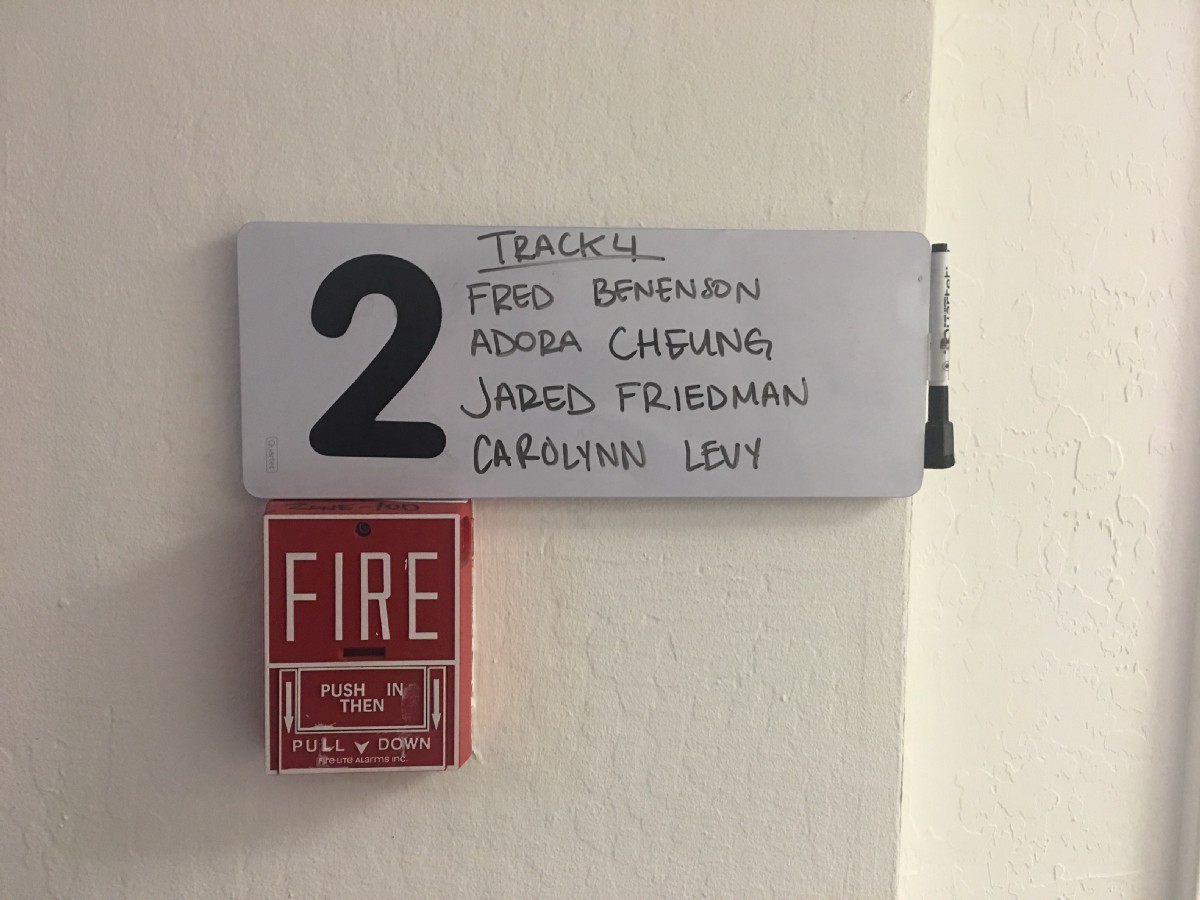

We were very motivated with all that we knew about Y Combinator especially what we learned from its alumni. It felt we could have some extra-ordinary opportunities, if we managed to get there. It was our 4th application. We asked for help several alumni who were very kind to review our application and give us a feedback on how we can improve it. We as well asked our customers who were YC alumni to advise us for the interview (they have a tool for that in YC).

When we got that invitation we felt ourselves a bit on the cross-road: on one hand we had this term sheet we can sign right away, on the other — a chance to get into acceleration program #1 in the world.

As term sheet had a clause limiting us for 30 days to accept any new investment offers, we decided to ask Vendep to make an exception for YC. But Jupe proposed just to postpone a bit with signing TS so we don’t have any obligations before the interview. We agreed but were a bit nervous: if YC says no, would it influence on fund decision or not?

Usually teams that are invited to Mountain View have only one interview with YC partner and its colleagues. Perhaps, our commission who was lead by Aaron Harris couldn’t make its decision and we were invited for a second interview which was few hours later. It’s was funny that one of the members on the second commission was our customer’s CEO.

But at the end we didn’t get through. In the letter we received from YC they said they liked us a lot as founders but they don’t see a “unicorn” opportunity in what we’re doing. That is hell of a comment. But actually it made us think of how we approach our company’s future. If you start asking yourself whether or not your vision of the company is bold enough for you to become a unicorn, you can literally change a lot in your company.

Luckily, YC decision didn’t influence on Vendep readiness to sign the docs, so right after we got back to Helsinki (and with almost 1 month delay) we finally signed term sheet with Vendep Capital and started to prepare for the deal.

Usually investors are looking for the answers on a few basic questions:

- Why you’re doing what you’re doing?

- What are the market opportunities for your product or service?

- How much of that market are you willing to take over?

All in all we met with 5–6 VCs and several angels before we signed up with Vendep. Each time when we were answering this questions , we were not only trying to persuade possible investors to give us some money but we were checking with ourselves if truly believe in what we say.

DD, IA, SHA…

As soon as we’ve signed term sheet with Vendep, we accurately draw the line in talks with other VCs. As Vendep was ready to invest all that we needed, we decided to stay only with them. Gathering a syndicate could delay signing the deal even more.

Our next stop was due diligence. We’ve been reviewed in terms of legal clearness: bylaws, current shareholders agreement, customers agreements, employees agreements and so on. Possible legal & book-keeping risks were estimated so fund could be sure that our company doesn’t hold any outstanding obligations or debts that could influence our future and put the investments at risk.

We were always quite accurate with all the paperwork we were doing with our customers & partners but never-the-less we’ve got a lot of “red flags” in the final due diligence resolution. That surprised us a lot. But we managed to work this out by creating a road-map of how we going to fix this issues. Luckily, most of them were quite minor.

During this stage Fund as well interviewed our customers in Russia, Europe & USA to learn how they were using our service, how satisfied they are and so on. We’ve been a bit nervous about that as didn’t ask anyone to praise us. Vendep was satisfied with the results very much. And later we learned that this is a common practice for b2b companies.

As soon as we agreed on how we fix all the issues discovered during due diligence, we moved to the next stage — preparing deal documents, including Investment Agreement (IA) and Shareholders Agreement (SHA). To speed up the process we all decided to use publicly available Serieseed.fi templates.

When negotiating these docs, they were reviewed by our lawyers and current investors. Initially we thought we could manage to finalise everything by the end of the year. But that turned out to be too optimistic. We settled everything only by the end of January. And in February all the docs were signed by all the parties. So, it took us 3 months from signing term sheet to signing deal docs.

As an outcome

A quick sum up of all our learnings:

- Investment round consists of three major stages: analysis & preparations, search for the investors and the deal itself. A lot of different things can happen with you during all these stages. So, plan beforehand, don’t wait until you run out of money. Or, as we had, get on break-even so you have enough time to execute the deal.

- Calculate deal parameters in advance — understand how much do you need, how much are you willing to trade for this sum, review the valuation you’ll get. Of course, these parameters may have some flexibility. But don’t expect someone else will calculate that for you.

- When you approach investors be sure to do your homework: look at the deals they had: type of companies and stages they invest in, how much money do the give. If you can, talk to the founders who already work with them. Or at least make some media research.

- Be sure to understand your investor’s motivation. Why they want to invest in you? How long they are planning to keep up with you? Remember that VCs usually plan to participate on the next stages. E.g., Vendep told us that they allocate up to €4 mln for each company in their portfolio. And they plan to stay with the team for 7–10 years before exit.

- Prepare your pitch and invest deck. As well, be sure to have a business plan & daily/weekly/monthly report on your key metrics. This will not only show your potential investors how well prepared are you but as well speed up decision making for them.

- And be confident in what you’re doing and why. Every early investor looks at the team and results it shows. If you have a good team & decent execution, you’ll definitely find money for your company. Even if investors doesn’t know all the specifics of your market & product, they will trust your guts if your team shows good results already.

New investment round — new opportunities. We plan to grow and we need people to support that growth and speed things up.

We’re looking for:

- frontend- & backend-developers (always),

- content-manager,

- analyst.

And in the very near future we’ll be looking for:

- marketing manager,

- growth hacker,

- business development manager,

- UI/UX-designer.

If you want to join our team, please send us a line on hi@appfollow.io.

P. S.

We as well want to share two docs we developed during this time:

- This is a very simple cap. table to help you calculate your future investment rounds.

- A quite basic business plan template that can help you start your calculations. Most likely you’ll build your own, this one can serve as a base.

Hope, this story of ours will help you raise investments for your startup. If you still have questions, please, get in touch, we’ll be happy to help.

If you like this post, don’t be shy, click ? as much as you can.